tax on venmo money

Individuals who have sold cryptocurrency on Venmo during the 2021 tax year will receive a Gains and Losses Statement irrespective of their state of residence. For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence.

Ebay Sellers Face 1099 K Tax Headache Under New Irs Rule Bloomberg

What are tax holds.

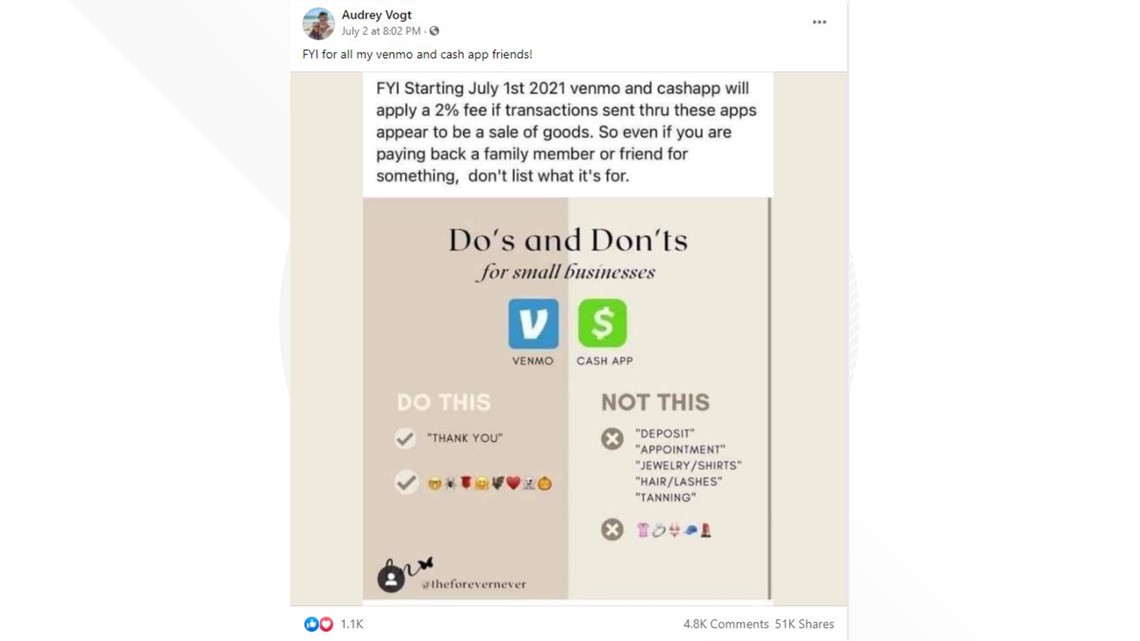

. 1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service. Those fears are largely unwarranted. Starting with the 2022 tax year merchants who receive more than 600 via payment apps will receive a.

Consider seeking advice from your financial and tax advisor. Now in addition to freelancers and. Venmo charges a standard fee of 19 plus 010 USD on every seller transaction and this fee is non-refundable.

Keep in mind that Venmo users paying a. Theres a lot of misinformation surrounding new IRS cash app rules that went into effect January 1 2022 and many users worry their transactions on apps like PayPal Zelle. If you make more than 600 through digital payment apps in 2022 it will be.

All about taxes on Venmo. The Venmo tax is relevant to merchants who accept payments via Venmo. Most people will not suffer any tax complications from the new IRS rules and in most cases you wont have to report that your.

Venmo is a service of PayPal Inc a licensed provider of money transfer services NMLS ID. Whether its splitting the restaurant bill with. Rather small business owners independent.

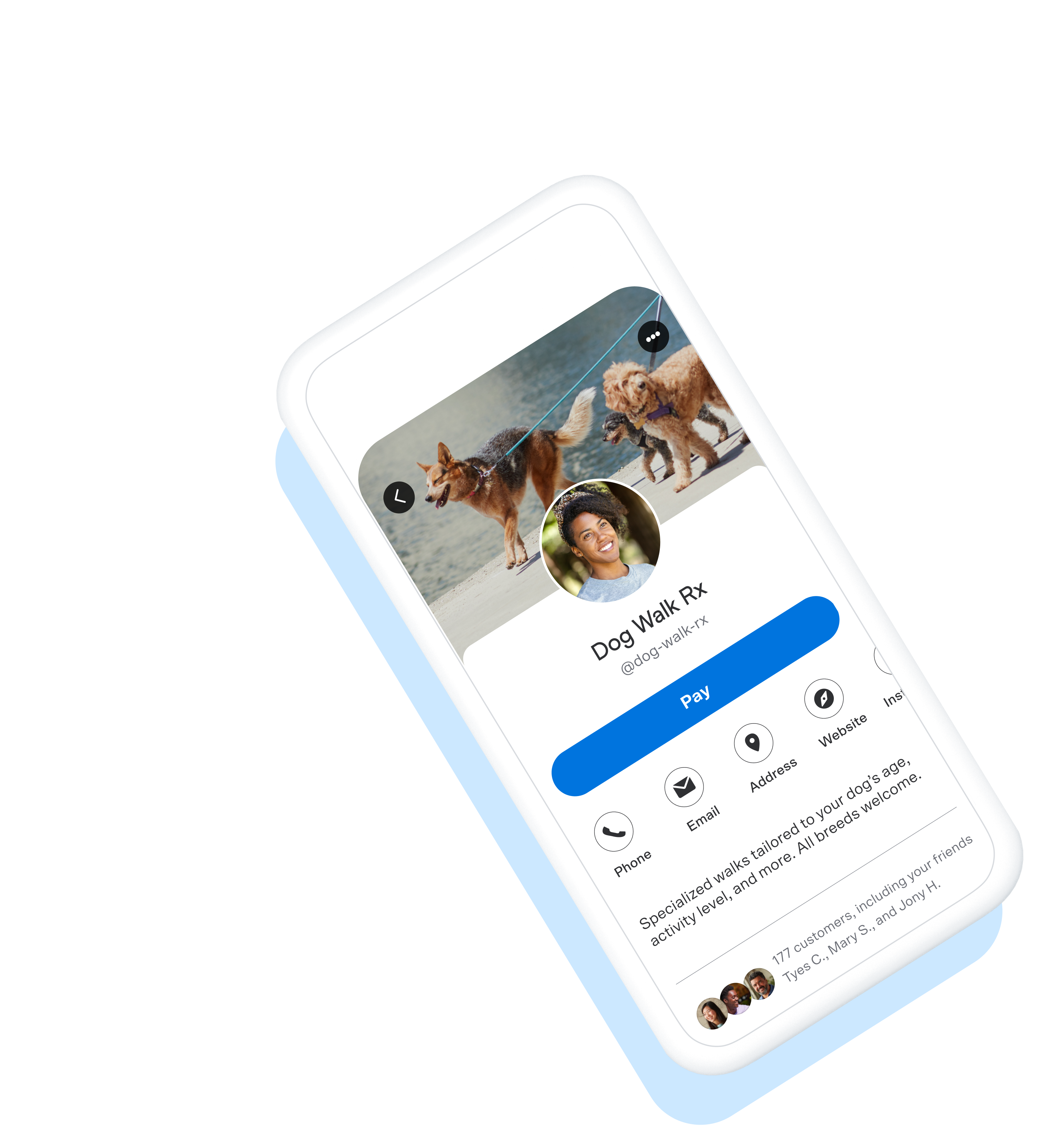

Venmo business fees. The new Venmo income reporting rules apply to an aggregate of 600 or more in income on goods or services through the calendar year. If youre a US.

The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. For most states the threshold is. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the.

Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to report. Youll Owe Taxes on Money Earned Through PayPal Cash App and Venmo This Year. Due to lower federal IRS reporting thresholds for 2022 you may need to provide Venmo with your tax information if youre receiving payments for sales of goods and.

Learn more about what tax. Individuals and small businesses alike have adopted peer-to-peer P2P payment apps to make convenient mobile money transfers. All custody of and trading in cryptocurrency is performed for Venmo by its licensed service provider Paxos Trust Company.

9 2022 117 PM PT. 6 hours agoFact or Fiction. Citizen making money from the sale of goods or services the IRS considers it taxable income regardless of how or where youre paid.

1099 K Changes What Do They Mean For Your Side Hustle Ramsey

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You 6abc Philadelphia

Fact Or Fiction Could We Soon Owe Taxes On Venmo Payments

Venmo Will Have New Service Fees But You Have To Opt In Verifythis Com

The Irs Is Not Taxing Venmo Zelle Cash App Transactions Khou Com

The Taxman Cometh The Irs Wants In On Your Venmo

Ease Of Doing Business Vs Tax Implications Paypal Venmo Etc Included In 600 Tax Reporting Rinewstoday Com

Reporting Requirements For Payment Apps Effective January 1 2022

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

If Your Business Uses Venmo Read This Now Mobile Law

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post

New Tax Law Requires Third Party Sellers To Pay Taxes On Earnings Over 600

3 Ways To Avoid Taxes On Cashapp Venmo Paypal Zelle Legally Youtube

1099 K Myths Venmo Paypal Payments The Turbotax Blog

Venmo Paypal And Cash App To Report Payments Of 600 Or More To Irs This Year What To Know Fox Business

The Venmo Tax How To Make Money And Stay Out Of Trouble With The Irs Mountain Dearborn And Whiting Llp